|

| Panorama Tower, an 821-unit apartment tower scheduled to open this fall at 1101 Brickell Ave. in Miami’s booming Brickell apartment district, is targeting a “Walker’s Paradise” score of 96. |

With the latest supply wave in the U.S. apartment market building to a crest, sales of apartment properties declined a steep 43% in the first quarter of 2017 from a year ago, easily the largest sales volume drop among the major property types.

Average apartment rent growth has also flattened out over the last several quarters, especially in CBDs where developers have piled on new units catering to a relatively small pool of high-end luxury renters. That supply pressure is reflected in the vacancy rates of 4- and 5-Star properties, which has increased year over year, according to data presented last week at CoStar’s State of the U.S. Multifamily Market First-Quarter 2017 Review and Outlook.

For the most part, rent growth and sales volume have cooled off across more than a dozen of the nation’s hottest multifamily markets from the same period a year ago, according to Lee Everett, managing consultant for CoStar Portfolio Strategy, who presented the outlook with CoStar Director of Advisory Services Michael Cohen and apartment research strategist John Affleck.

Despite the large amount of new units added and flat apartment price growth at the top end of the market, especially in gateway markets, overall apartment value growth has managed to hold fast in recent quarters, according to Everett, citing data from the first-quarter 2017 CoStar Commercial Repeat Sale Index.

Apts. with High Walk Scores Stand Out

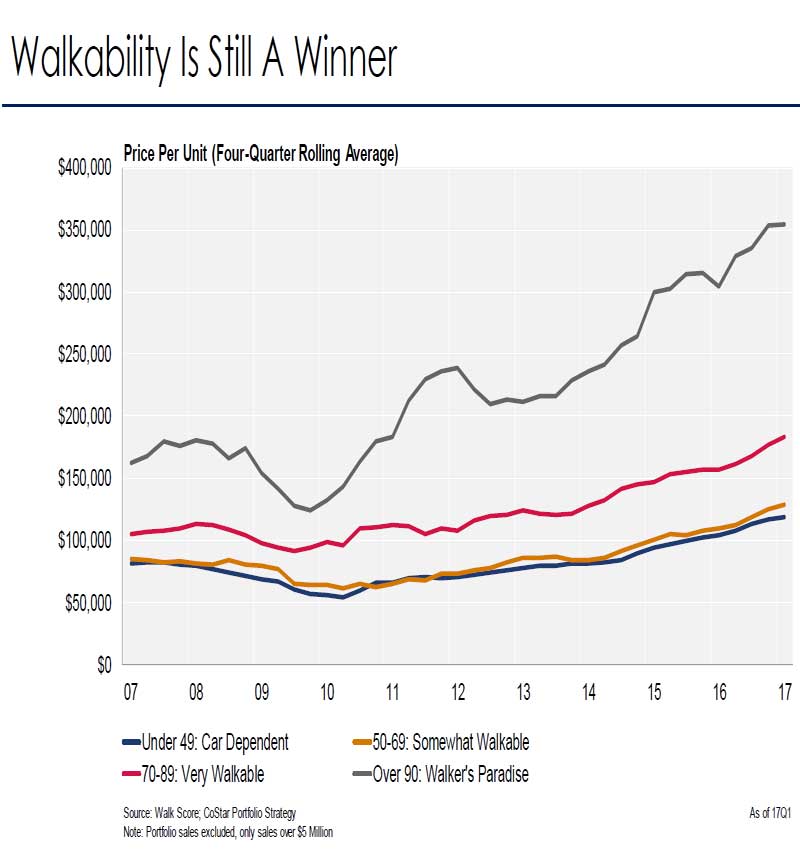

However, one segment of the high-end urban apartment market continues to stand out. Those in the most walkable locations continue to outperform, based on a CoStar analysis of apartment sales ranked by price per unit.

Apartment buildings with Walk Scores more than 90, denoting a “walker’s paradise” based on an algorithm awarding points for proximity to businesses, parks, theaters, schools and other common destinations, recorded a 16% increase in price paid per unit year-over-year in the first quarter of 2017.

Since 2010, CoStar found per-unit pricing has increased 167% for the most walkable apartment properties.

The scores are generated by Seattle-based Walk Score, which assigns a numerical walkability score to any address in the U.S., Canada and Australia.

“Walkability is the new market reality, be it to a transit station or your actual office,” Everett said. “People are tired of commuting, especially empty nesters who have commuted all their lives. That has pushed a lot of value growth and nodal urban development.”

Panorama Tower, an 83-floor apartment building under construction by Florida East Coast Realty in Miami’s booming Brickell submarket, sports both a Walk Score of 96 and a Transit Score of 92. The tower, connected to retail, medical office space and a hotel, will be the tallest residential building on the eastern seaboard south of New York City when it opens this fall.

While the past several years of increasing rents and lack of affordability may cause the value growth to slow down even in high walk-score properties, Everett expects their sale prices to pick up where it left off after the supply pipeline thins out a bit.

“As a renter by choice, I can tell you that walkability was a deciding factor for me, given that my apartment is 2 1/2 blocks from the office,” commented Everett’s CoStar colleague, Michael Cohen.